Yes, Even For US Citizens Living Abroad

Ah, the tax season. That annual time of the dreaded IRS rules, Forms, excel sheets, invoices, and whatnot.

Not the favorite time for most people. Except for people like us – we’re U.S. Tax Pros. We love taking on your US tax nightmare so you can chill.

If you are a US citizen living abroad, and struggling to file taxes, you are not alone. Each year we help many people like you not just file taxes but also save a LOT of money by leveraging the right tax breaks.

So how can you file your US tax returns even when you’re living outside of the US? Just sit back and relax. Our team at U.S. Tax Pros will take care of all your tax problems and we will provide solutions at very reasonable prices.

Who Are U.S. Tax Pros?

U.S. Tax Pros is a New Zealand based company that was established in 2020 and has been happily serving US citizens living abroad since then. We have offices in the greater Auckland area and we use a multi point review system to ensure that your returns are prepared right.

We are tax professionals dedicated to minimizing your tax liability.

We have XERO certified professionals to help you at every stage. And not to mention FBAR audits. US citizens living abroad may have to file FBAR (Foreign Bank Account Report) each year. It must be filed timely and accurately, failure of which may lead to various IRS fines and penalties. US TAX PROS charges no fee for FBAR advice.

Need Help Filing Your Taxes?

Whom And How Do We Help?

U.S. Tax Pros was exclusively established for Americans by Americans who are living abroad. We provide simple and hassle free ways of filing your taxes.

We offer tax preparation for US citizens and also provide advisory services. We at U.S. Tax Pros understand the complexity and troubles of a US citizen while filing taxes who is living abroad.

We will not only make the process simple but also minimize your tax liabilities while keeping you fully compliant with the IRS.

How We File Your Taxes And Minimize Your Tax Liabilities?

We understand the nuances and complexities of US taxes and the billions of endless Forms and Schedules etc to be filled and filed within deadlines.

Let us tell you some of the tax deductions that you could possibly qualify for.

1. Deductions for Charity

Individuals can deduct up to $300 for US charitable donations & Foreign Red Cross they made in the year. It can be claimed in the line 12b of the form 1040.

2. Child tax credit (CTC)

Taxpayers can avail child tax credit which has now been raised up to $3,600 per child between age 0-5 and $3,000 per child between the ages of 6-17. But remember that child tax credit can be availed by you only if you pay the majority of child care for at least one child under the age of 17.

3. Credit for self employed workers

Self employed individuals can claim up to $200 for each day they were unable to go to work due to Covid-19 and related issues. To check the claims, see Form 7202.

You can also claim credit under Form 7202 if you couldn’t go to work as you needed to look after a family member suffering from Covid-19.

which means it can be subtracted from the adjusted gross income to reduce taxes.

If your medical expenses were greater than 7.5% of the adjusted gross income than it can be deducted under the medical expenses deduction.

4. The state and local tax deduction

The State and Local Tax Deduction (commonly known as SALT deduction) includes property tax and either of the income or sales tax. Generally property and income tax are the primary drivers of the SALT deduction and not the sales taxes.

5. Mortgage interest deduction

A homeowner can deduct the interest they pay on the loan to build, purchase, or renovate from taxable income. This is an itemized deduction.

6. AOTC and LLC for students

The AOTC stands for American Opportunity Tax Credit. AOTC is worth up to $2,500 per student and is available for education expenses from your first four years of higher education. It includes tuition, books and classroom supplies.

Lifetime learning credit (LLC) can be claimed for undergraduate courses, in addition to graduate courses and professional degree courses. LLC also covers the cost of classes that help you learn or improve job skills.

7. Members of the military and reserve members

An active member of the US armed forces can deduct the expenses for moving / traveling to a new permanent station. This deduction can be claimed under Form 3903.

Also, the members of the reserve forces can claim the deduction if they had to travel greater than 100 miles to perform various reserve services. One can use Form 2106 for the claim.

8. Alimony

One can deduct the alimony payments if the divorce agreement took effect during 2018 or before as after that tax reform eliminated this deduction. Check Schedule 1 for this claim.

9. Individual retirement account

Traditional individual retirement accounts, or IRAs, are tax-deferred, meaning that you don’t have to pay tax on any interest or other gains the account earns until you withdrawal the money. The contributions you make to the account may entitle you to a tax deduction each year.

10. Medical expenses

Medical expense deduction is an itemized deduction,

Thus make sure that your total itemized deduction is more than the standard deduction.

There are many more claims and deductions that you can possibly make and save your hard-earned money.

Our team at US Tax Pros will look into every possible condition and deliver you the best.

Need Help Filing Your Taxes?

Important Tax Deadlines You Shouldn’t Miss

As if the tax nightmare wasn’t enough, there are deadlines you absolutely must file your returns by. We’re sharing some important dates here and if they make you panic, you know you can contact us right away and we’ll help you out.

| Date | Event | Variations |

|---|---|---|

| January 18, 2022 | 2021 4th instalment of Estimated Tax Payment Due Date | |

| January 24, 2022 | 2022 Tax Season Begins E-File opens | |

| March 15, 2022 | 2021 Form 3520-A Due Date for calendar year non-US/foreign trust | |

| April 18, 2022 | 2021 Federal Tax Return Due Date | April 19, 2022, if living in Maine and Massachusetts |

| April 18, 2022 | 2021 Form 3520 Due Date | April 19, 2022, if living in Maine and Massachusetts |

| April 18, 2022 | 2021 Substitute Form 3520-A Due Date for calendar year non-US/foreign trust | April 19, 2022, if living in Maine and Massachusetts |

| April 18, 2022 | 2021 FBAR Due Date | April 19, 2022, if living in Maine and Massachusetts |

| April 18, 2022 | 2022 1st instalment of Estimated Tax Payment Due Date | |

| June 15, 2022 | 2021 Federal Tax Return Due Date for US Citizens and resident aliens living and working outside the US as of April 18, 2022 | |

| June 15, 2022 | 2021 Form 3520 Due Date for US Citizens and resident aliens living and working outside the US as of April 18, 2022 | |

| June 15, 2022 | 2021 FBAR Due Date for US Citizens and resident aliens living and working outside the US as of April 18, 2022 | |

| June 15, 2022 | 2022 2nd installment of Estimated Tax Payment Due Date | |

| June 15, 2022 | 2021 Form 3520-A Due Date for non-US/foreign trust with fiscal year ending on 31 March 2022 | |

| September 15, 2022 | 2022 3rd instalment of Estimated Tax Payment Due Date | |

| September 15, 2022 | 2021 Form 3520-A Due Date for calendar year non-US/foreign trust with 6-month extension | |

| October 17, 2022 | 2021 Federal Tax Return Due Date with Automatic 6-month Extension | |

| October 17, 2022 | 2021 Form 3520 Due Date with Automatic 6-month Extension | |

| October 17, 2022 | 2021 FBAR Due Date with Automatic 6-month Extension | |

| December 15, 2022 | 2021 Form 1040 discretionary 2-month extension | |

| December 15, 2022 | 2021 FBAR Due Date with discretionary 2-month extension | |

| December 15, 2022 | 2021 Form 3520-A Due Date with 6-month Automatic extension for non-US/foreign trust with fiscal year ending on 31 March 2022 |

We are here to help you file your taxes. Get in touch with us as soon as possible to get maximum benefits.

Just remember procrastination has done good for none. And all you need to do now is get in touch with us – and then you can procrastinate all you want while we do your taxes.

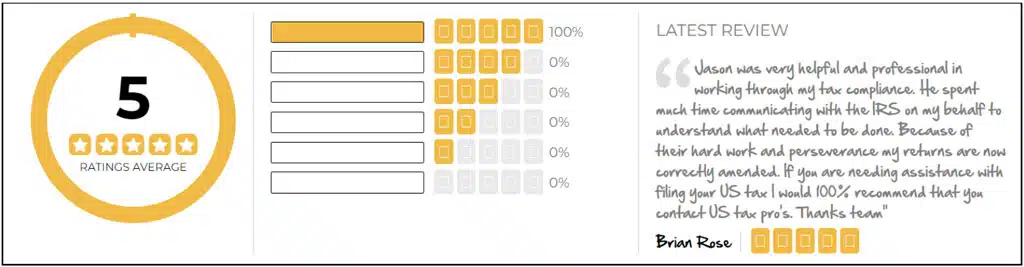

Why Our Clients Love Us And Only Us

We are proficient and effective – it’s not just who says so. See our testimonials – they always make us blush.

Let Us Help You

We have four different packages namely Basic pack, Professional pack, Corporate pack, and Streamlined filing procedure which includes the Federal tax return and FBAR/FATCA Forms as needed.

For more details log on to www.ustaxpros.co.nz.

In our years of helping US citizens abroad with filing their tax returns with the IRS, we’ve seen many people who found it difficult before they found us. We know that taxes are confusing and that’s why we use a multi-point review system to ensure your taxes are prepared right.

Let US Tax Pros know if you have any questions or need help. We’re here to make your life easier! Mail us at info@ustaxpros.co.nz.